The How To Obtain Bankruptcy Discharge Letter PDFs

Table of ContentsGet This Report about Copy Of Chapter 7 Discharge Papers7 Simple Techniques For Copy Of Chapter 7 Discharge Papers7 Simple Techniques For Obtaining Copy Of Bankruptcy Discharge PapersSome Ideas on Copy Of Chapter 7 Discharge Papers You Should KnowEverything about How Do I Get A Copy Of Bankruptcy Discharge Papers

Nevertheless, if you have actually lost your discharge papers, you can still get a duplicate if you require it for any type of reason. The top place to check when you need a copy of your bankruptcy discharge documents is with the Staff of the Court where your case was submitted. Some courts will certainly enable you to look the document online absolutely free, while others charge a charge for searches.

There is normally a ten cent per web page retrieval charge, but if you spend less than $15 each quarter of the year, the service is complimentary. You might need your instance number in order to look the data source. It is not unusual to see solutions online that offer to send you your discharge papers for a fee, occasionally as high as $40 or more.

3 Simple Techniques For How Do You Get A Copy Of Your Bankruptcy Discharge Papers

Try to stay clear of making use of such services and also acquire your documents with the court clerk or PACER to ensure you are not the target of a rip-off (bankruptcy discharge paperwork). If you or an enjoyed one is dealing with economic trouble, insolvency might be the answer so you can stop the lender calls as well as get back on your economic feet.

You can call us to set up for a no responsibility assessment or complete the simple type online.

It is necessary to keep your (or copies) in a secure location. Life takes place - and also at some point in time, you may locate that you require this file, yet for one reason or another, you can not discover it. Thankfully, there are a number of methods you can set about changing your copy of your authorities bankruptcy discharge.

There is an excellent chance that your attorney will certainly still have a copy in his or her data. If not, he or she may be able to access the Court's records digitally to publish the requested paper.

How Copy Of Bankruptcy Discharge can Save You Time, Stress, and Money.

If it is greater than you agree to pay, explore your various other choices (see listed below) for getting a copy of the insolvency discharge. You can also ask for a personal bankruptcy discharge copy from the Staff's workplace located in the area and department where the insolvency instance was filed. The insolvency staff will bill a tiny fee for this solution - how to get copy of bankruptcy discharge papers.

You can locate the contact info for your Clerk's office making use of the state links on the right side of this web page. Do you understand if your situation was online filed with the insolvency court? If you submitted personal bankruptcy within the previous couple of years, there is a good chance that it was, as well as for instances that are online submitted, most of the documents in the event are stored online in the Court's PACER system.

Several individuals intend to obtain a duplicate of their personal bankruptcy discharge documents and also various other personal bankruptcy paperwork, as well as there are several reasons. Probably you require your full personal bankruptcy data for your documents, or you're wanting to get a brand-new task and need a copy of your discharge papers. Usually a borrower will need access to their personal bankruptcy documents to remedy their credit history report after their instance is released.

It is very important to keep a duplicate of your bankruptcy situation. Getting lawful guidance from an experienced insolvency lawyer is constantly vital. https://www.diigo.com/item/note/9mcqe/ndjr?k=a1f1da28029591b2a2069e66f27e79c8. Additionally, they can evaluate your situation documents if questions arise after her response discharge. A bankruptcy lawyer can aid you obtain personal bankruptcy records for you records and also future use.

Our Chapter 13 Discharge Papers Statements

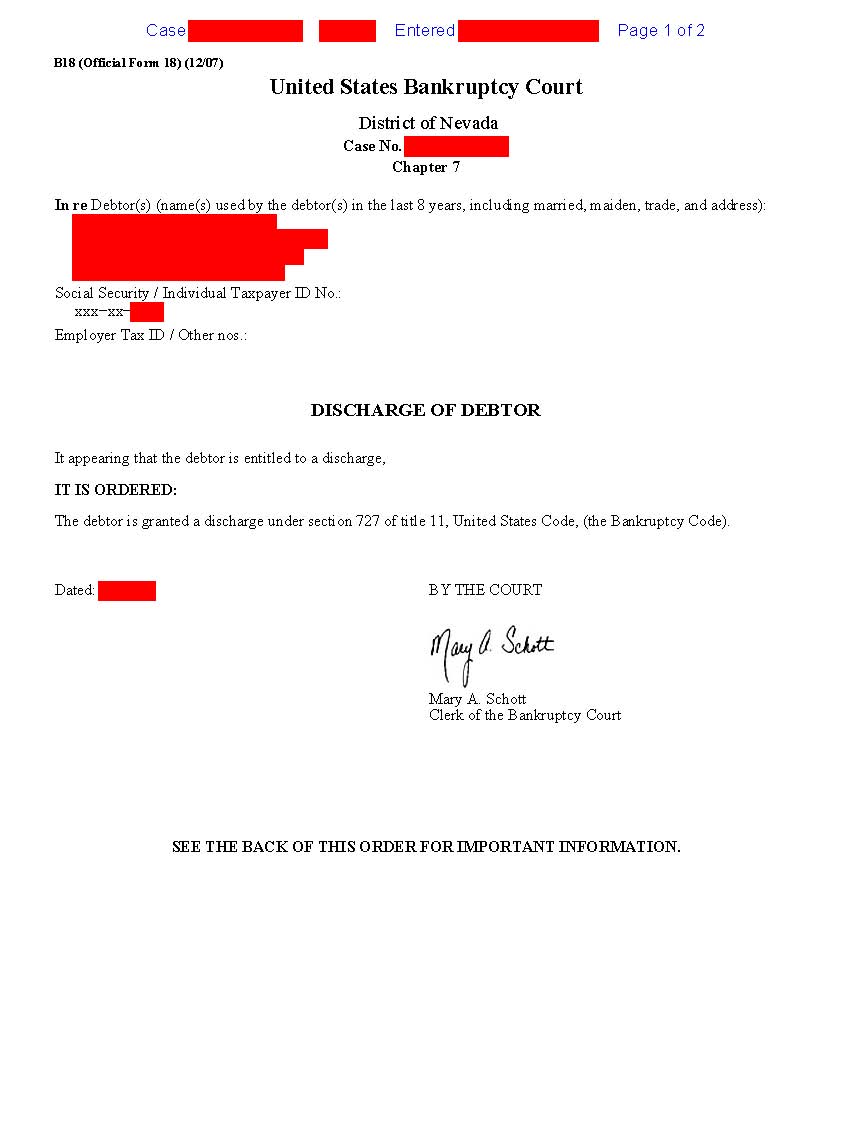

Having a duplicate of your insolvency records can be very useful in the occasion you get filed a claim against on a financial debt that must be discharged or require to challenge a discharged financial debt with the credit scores reporting firms. An insolvency discharge order releases the borrower from personal responsibility for numerous types of financial debt (https://www.citybyapp.com/professional-services/copy-of-bankruptcy-discharge-papers).

A financial institution can not accumulate upon a financial obligation when the bankruptcy court releases it in either a phase 7 personal bankruptcy or a chapter 13 bankruptcy. For this factor it is necessary to keep a copy of your insolvency discharge. If you shed or lost your copy you need to attempt to obtain a duplicate of your insolvency records.

Commonly when there are mistakes on a credit history report. Credit score reporting firm demands usually call for a copy of the discharge to make required adjustments. When the personal bankruptcy court problems a discharge order for unprotected debt, many otherwise all bank card financial obligation, clinical financial debt, as well as other unprotected kinds of financial obligation can no more be accumulated upon by your financial institutions.

A debtor will wish to keep evidence of their bankruptcy declaring if a credit history seeks to gather on an unsecured financial debt after the bankruptcy is completed. Your personal bankruptcy records will certainly consist of all of the financial institutions you owed money to. It will additionally consist of a duplicate of your discharge order. Safe creditors are dealt with in different ways after a discharge order is provided.

Little Known Facts About How To Get Copy Of Bankruptcy Discharge Papers.

Typical kinds of protected financial debt consist of an auto lending as well as financial debts held by home loan companies. The legitimate lien on properties that an insolvency declaring has actually not gotten rid of in this issue will certainly remain effective after personal bankruptcy lawsuits. A safeguarded creditor needs to apply the lien to recover the belongings of the residential or commercial property based on the lien.